How to Apply

Ministry of Finance, Government of India has provided the concessional rateGoods and Services Tax (GST) on Cars for Persons with Disabilities (PWD) vide SlNo. 400 of Notification no. 1/2017-Integrated Tax (Rate) dated 28th June, 2017(amended from time to time).

Accordingly, Ministry of Heavy Industries has introduced this scheme in 2018. Issuing the certificates to PWDis a manual and rigorous process and issued to these persons having disability equal to or greater than 40 % irrespective of the fact that the applicant drives the vehicle himself orotherwise. Vehicles permitted for GST concession are:

The concession can be availed for following motor vehicles of length not exceeding 4000 mm only, namely

- Petrol, LPG or compressed natural gas driven vehicles of engine capacity not exceeding 1200 cc

- Diesel driven vehicles of engine capacity not exceeding 1500 cc.

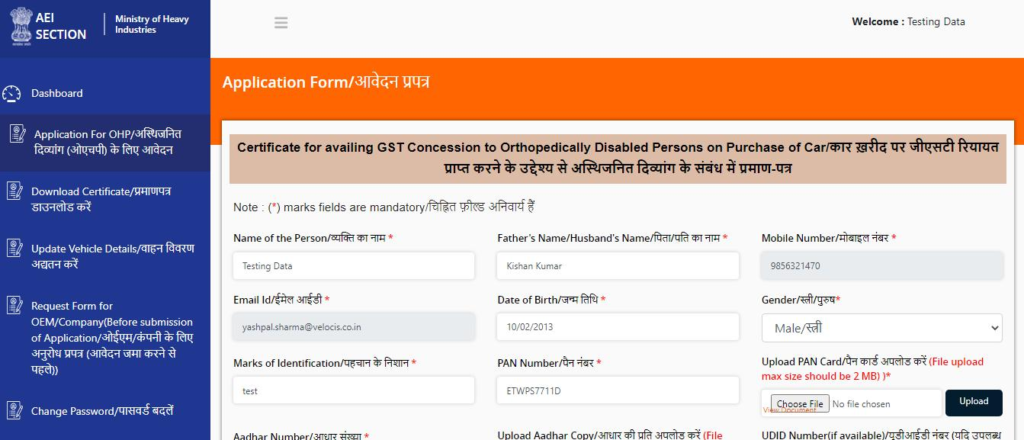

As per the guidelines, the applicants who wants to take the benefit of GST concession are required to submit the following information in the format:

- An application furnishing their personal and UDID details. Among other details, applicant is required to submit the details regarding vehicle model, dealer from whom the vehicle is to be purchased, name of RTO where vehicle is to be registered.

- In case, applicant does not have UDID number, a medical certificate duly signed by a medical practitioner and countersigned by Civil surgeon or a equivalent rank of a Government Hospital in prescribed format

- An affidavit by the applicant that he/she had not availed of this concession in the last 5 years and that he/she will not dispose of the vehicle with GST concession after purchase for a period of 5 years in prescribed format.

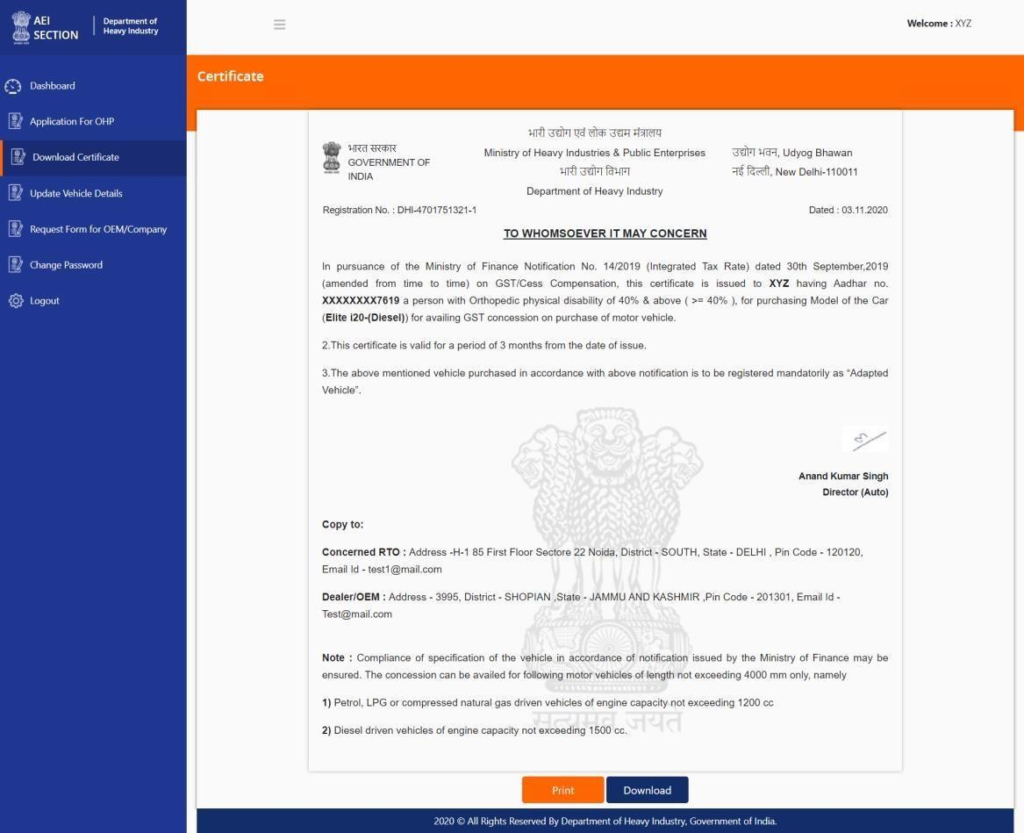

- The certificate provided will be valid for a period of three months form date of issue. All such vehicles through this certificate would be registered as “Adapted vehicle” as per Motor Vehicle Act 2019. The applicant is to inform Ministry of Heavy Industries about the purchase of the vehicle within 30 days of the registration of the vehicle.

Ministry of Heavy Industries would accept applications from applicants for GST Concession Certificate online only.

Before applying on-line

followings scan documents are required for uploading in the site:

- PAN card

- Aadhar Card

- UDID Card (in case you have UDID number)

- Photograph

- Signature

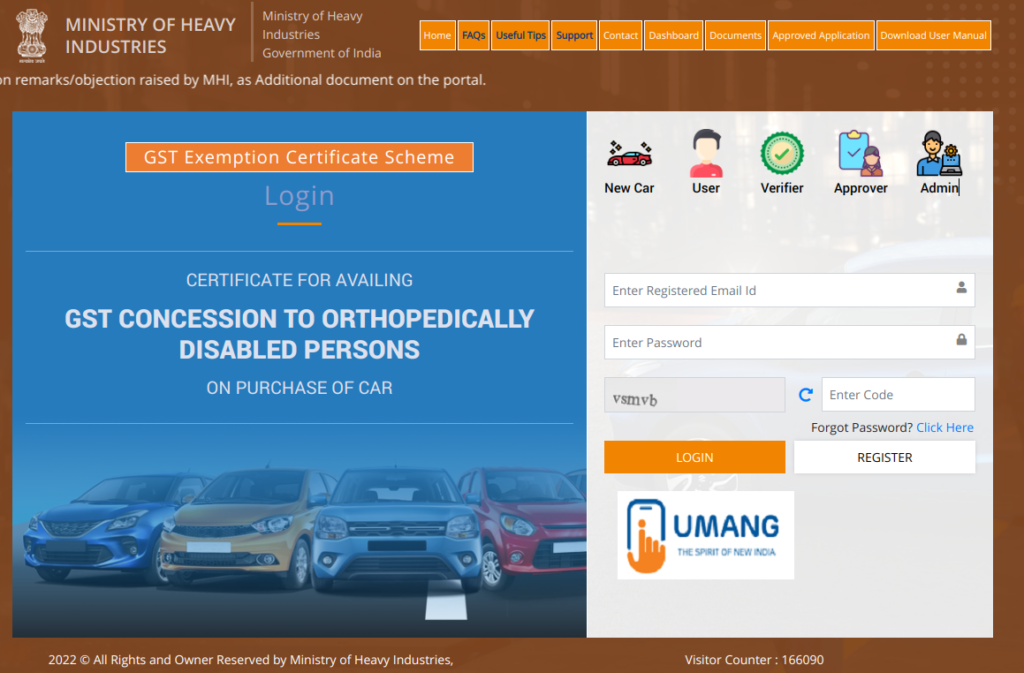

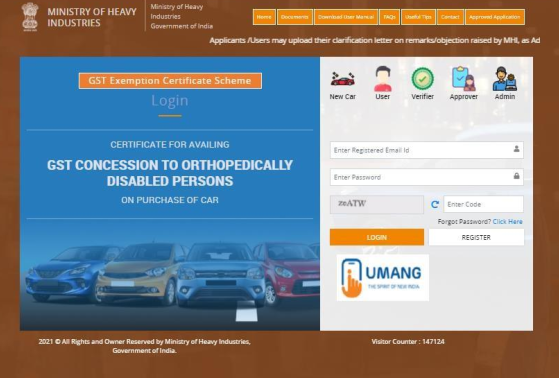

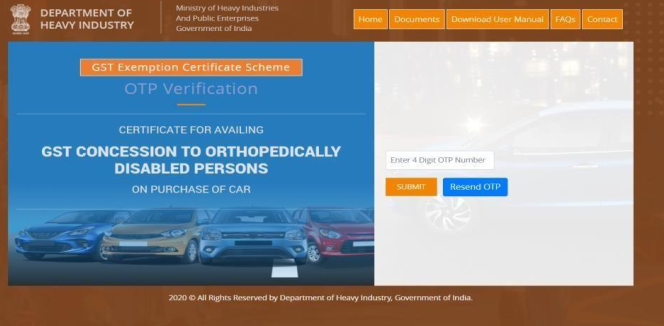

Step 1: Registration

Open the URL: https://dhigecs.heavyindustry.gov.in/ from any browser or device to access this site.

before registration, Kindly follow the steps

- As far as the requirement of disability certificate, UDID (Unique Disability Id) /Disability certificate issued by Ministry of Social Justice & Empowerment, is preferred.

- In any other medical certificate (other than UDID/disability certificate issued by Ministry of Social Justice & Empowerment), the name and registration number of the signing and countersigning authority should be clearly mentioned. The disability should be mentioned as permanent in nature. It must be issued by the competent authority.

- As per the disability guidelines, a disability certificate shall be issued by a Medical Board of three members duly constituted by the Central or State Government, out of which, at least one member shall be specialist from either the field of Physical Medicine and Rehabilitation or Orthopaedics.

- To know the competent Medical authority to issue Disability Certificate, the applicant may refer the URL mentioned below – http://www.swavlambancard.gov.in/findNearestMedicalAutority

- The applicant should ensure that his/her name is mentioned same in each and every document submitted by him/her.

- The certificate once issued will not be modified in any respect (model/dealer/RTO). The applicant should confirm from dealer whether he knows the whereabouts of this process of giving him concession & has the required trade certificate or not. Similar confirmation should be received from RTO side. No further changes will be made in the certificate once issued.

- During registration of applicants on this portal, fill all your details (name, email id, mob. no, Aadhar no) very carefully. Once you have entered wrong email id/name etc. you will not be able to register again.

- The applicant should mention the correct and authentic email id of dealer & RTO. Do not fill their email id from internet or other sources. Please confirm from their side only.

Start the Registration –

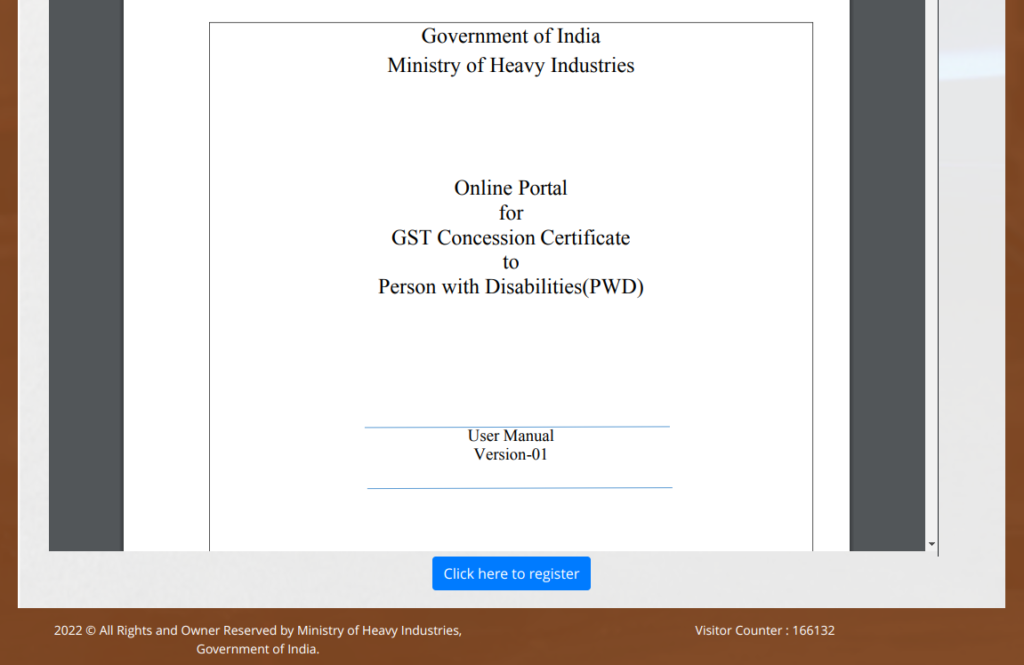

https://gecs.heavyindustries.gov.in/home/userRegistrationInstruction

(Click the Registration button in Bottom)

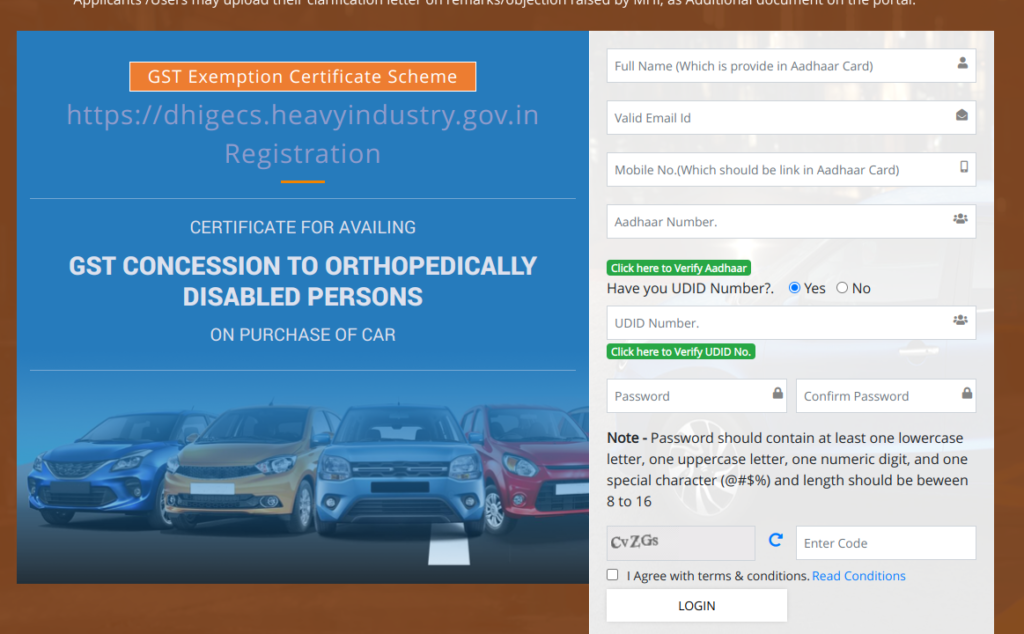

Fill the Valid Data

- Name : Please fill the valid full name as per the name written in Aadhaar card.

- Email : Please fill the valid email id.

- Mobile Number : Please fill the valid 10 digits mobilenumber.

- Aadhaar Number : Please fill the 12 digits valid Aadhar number (after that “Click here to Aadhaar” button). If it matches then you will get the OTP on your registered mobile number. Otherwise a message “Aadhaar number did not exist. Please enter valid Aadhaar number” will appear.

- Enter OTP : (in case Aadhaar no. is validated),please fill the OTP which is received in your registered mobile number. Thereafter, click on “Verify Mobile OTP ”. If your OTP matches, then enter following details.

- UDID number (Yes or No details) Have you UDID Number?: If you have UDID number then select “Yes” and if do not have UDID number then select “No”. If you select Yes then UDID filed will open.

Then fill the UDID valid number and after that “Click here to Verify UDID button. If your UDID number is verified then will open.

Password : Please create the password (Password must be at least one lowercase letter, one Uppercase, one number, one special character and minimum length 8 character.).

Confirm Password : Please create the Confirm password (Password must be at least one lowercase letter, one Uppercase, one number, one special character and minimum length 8 character.). Password and Confirm Password should be same.

Enter Code: Please fill the valid captcha code. Please Check the “I Agree with terms & conditions”. Now click on “REGISTER” button then will appear.

Then you will get email in your registered email id (which is provided at registration time) with 4 digits OTP and Please click here to activate your account. Open email and click on “Please click here to activate your account button available in your email content”

Please enter the 4 digits OTP (which is available in your email id) and login.

Dashboard

After successful registration, User Dashboard will open.

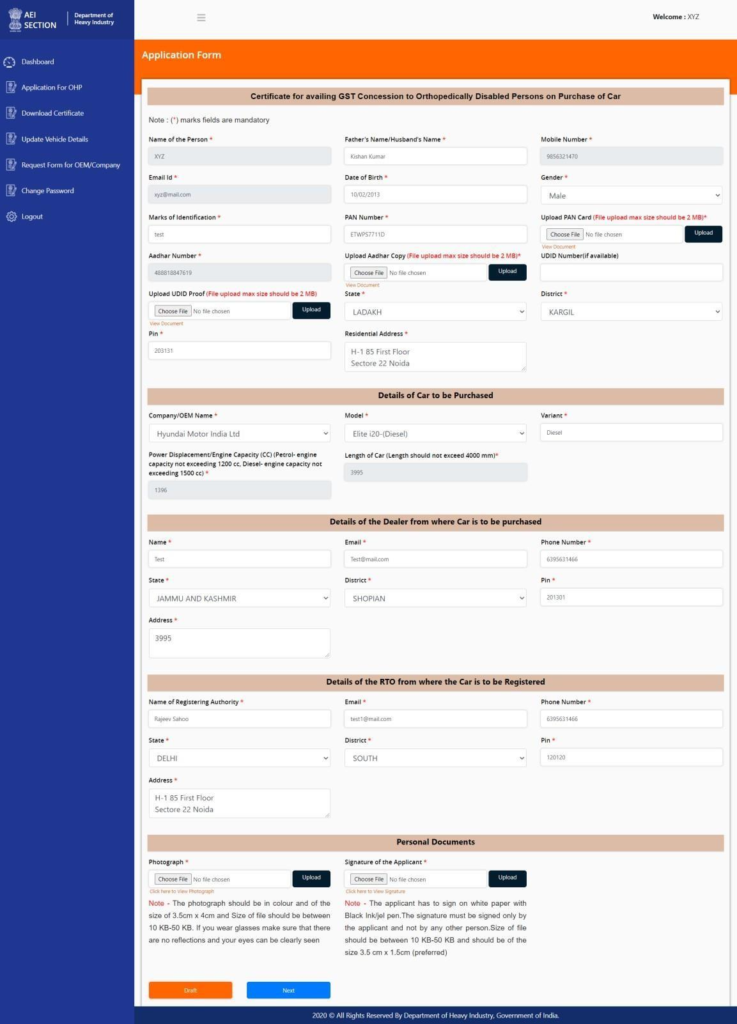

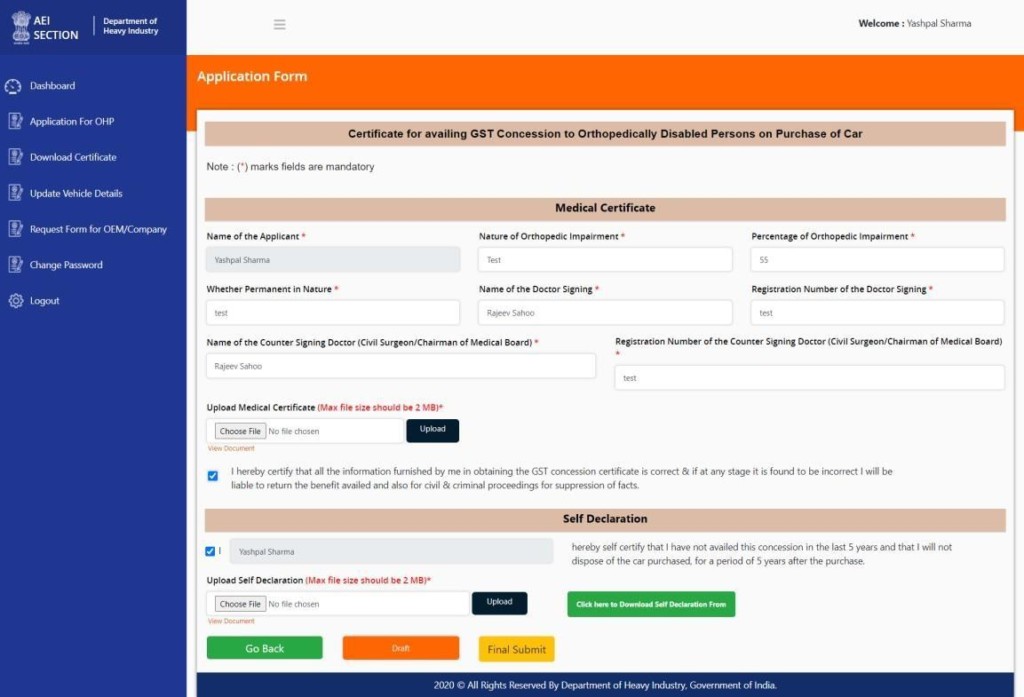

fill the details as per your UDID card and Aadhar Card. You can save your filled in information by clicking Draft button. After the fill the data, click next button.

Application Form

Please fill all mandatory fields (marked as *) and click on “Final

Submit” button.

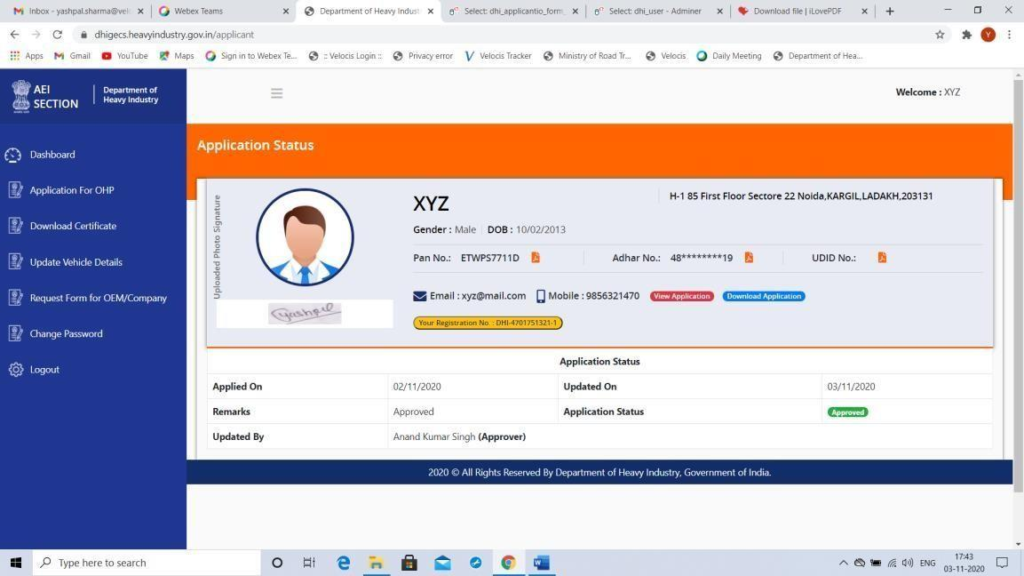

Application Status

After final submit, the Application Status window page will open.

You can view progress of your GST Exemption Certificate. Once your status is Approved, click on “Download Certificate”.

Certificate

You can now Download or Print your Certificate

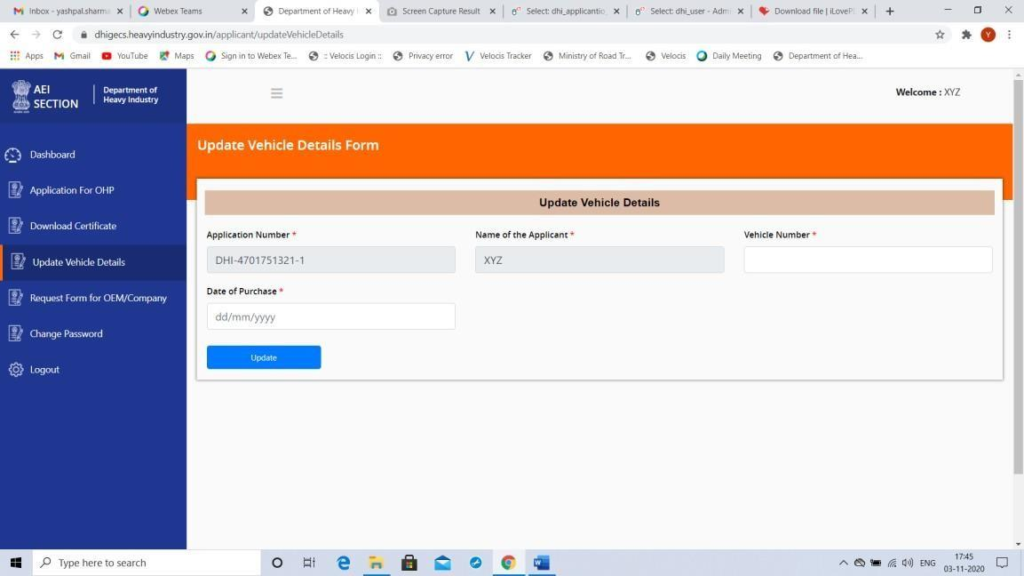

Update Vehicle Details

It is mandatory to update vehicle details after you purchase vehicle. Click Update Vehicle Details. You have to enter Vehicle number and Date of Purchase.

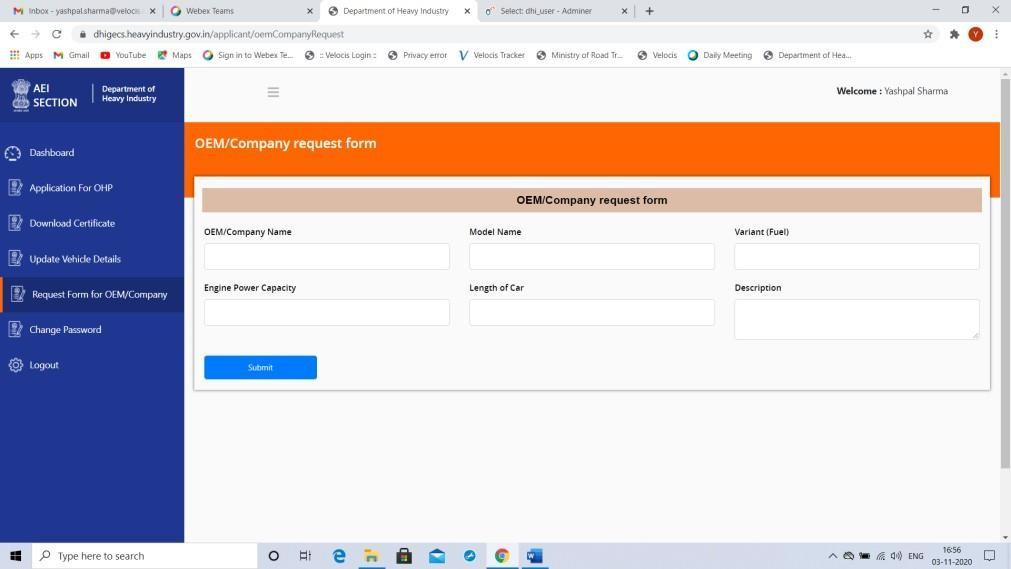

Request form for OEM/Company

Efforts have been made to include OEM/Company or model of the vehicles in the list. There are chances that some of list of OEM/Company or model of the vehicles are not listed in the list. In that case, you can request for add new OEM/Company or model of the Vehicles. When you click on “Add New OEM/Company Request”

Add the relevant entries as given and click the Submit button.

Re-submission Application Form

For re-submission of the application form , login to your account, click on “Application For OHP” menu, send the application form for approval after the correction/updation of document in the application form.

Frequently Asked Questions(FAQ)

Who are eligible for this benefit?

Any Orthopedic Physically handicapped person having permanent disability of 40% & above can apply for the benefit under the scheme as per the Notification of Ministry of Finance bearing No. 14/2019 – Integrated Tax Rate dated 30th September 2019 as amended time to time.

Which type of vehicles can be purchased under this scheme?

In Compliance to the Notification of Ministry of Finance dated 30th September 2019, Cars ( automatic or manual ) having length less than or equal to 4m and engine capacity of not more than 1200 cc (petrol, Liquefied petroleum gases (LPG) or compressed natural gas (CNG) or 1500 cc (diesel) qualify for purchase under this scheme.

How much & which type of concessions can be availed on the strength of this GST certificate?

As per Ministry of Finance Notification No. 14/2019 – Integrated Tax Rate dated 30th September 2019 and notification no. 1/2017-Compensation cess (Rate) dated 28th June 2017, concession of 10% on GST can be availed through this certificate and zero cess would be pplicable. A person availing this certificate will have to pay 18% GST & no cess instead of 28% GST applicable cess on purchase of car.

When to apply & how to apply?

The applicant has to apply for the benefit before purchase of vehicle, GST refund after the vehicle is purchased would not be possible. For applying the applicant has to visit the URL https://dhigecs.heavyindustry.gov.in Here He/She can take help of user manual as a guide in filling the online application. After filling the application and uploading the required documents, he/she has to click on submit button and the application will be received by the department.

Which documentation are required for applying?

Copy of Aadhar, PAN, UDID( if available)/Disability Certificate and Self- declaration (legible documents) need to be uploaded on the portal while filling application.

Does an applicant need to obtain a fresh medical certificate in a particular format for availing this benefit?

A person having Unique Disability Id Card (UDID) (issued by Ministry of Social Justice and Empowerment, Govt. of India) or Disability certificate (issued by Central Govt./State Govt./District Govt. bearing the proper signature and seal of the issuing authority wherein their name and registration no. should be mentioned) do not need any other medical certificate.

However, if a person does not have either of the medical certificates as referred above, then duly-filled annexure B is required with signature and countersignature of orthopedic doctor and civil surgeon rank officers respectively with their seal indicating their name and registration no.

What is the time taken in the process of getting the certificate?

The certificate is issued within a month of receipt of the application complete in all respects.

Is there any validity period of the certificate such issued?

The certificate is valid for a period of 6 months from the date of issuance

Where to complain in case car dealer or RTO do not honour GST certificate issued by DHI?

In Such case, the matter may be brought to the notice of Federation of Automobile Dealers Association of India (FADA) and Ministry of Road Transport & Highways respectively.

What to do if the validity of certificate gets expired without the purchase being made?

During this COVID-19 Pandemic scenario, the government is providing the facility for validity extension of GST concession certificate. This extension is granted for a limited period and may be annulled at any time by the government. For seeking extension in validity period of issued GST concession certificate, following documents need to be sent / emailed (single pdf file) after expiry of existing certificate: –

- Application for seeking extension in validity period along with reason for non-utilization of GST concession certificate in details (on plain paper duly signed by the applicant)

- Copy of GST concession certificate

- Letter from Dealer confirming non-delivery of vehicle.

Can anyone request for change in GST concession certificate?

Request for change in GST concession certificate can be made only under these two circumstances:-

- Closure of dealership

- Discontinuation of model/variant.

Under no other circumstances, request for change will be entertained. No request for change will be entertained in case, incorrect details of dealer/RTO has been entered by applicant during submission of application.

For seeking change in GST concession certificate, following documents need to be sent / emailed (single pdf file) : –

- Application for seeking Change in Model/Dealer along with reason for change in details (on plain paper duly signed by the applicant).

- Copy of GST concession certificate.

- Letter from the Dealer confirming non-delivery of vehicle, supported by valid reason.

- Details of the New Dealer (Name, Address, email id) / Model as desired (Length and engine capacity should be as per specifications stipulated in the guideline).

GST Details

Compensation Cess [46, 8703]

Cars for physically handicapped persons, subject to the following conditions:

- a) b) [Following motor vehicles of length not exceeding 4000 mm, namely: –

- (a) Petrol, Liquefied petroleum gases (LPG) or compressed natural gas (CNG) driven vehicles of engine capacity not exceeding 1200 cc; and

- (b) Diesel driven vehicles of engine capacity not exceeding 1500cc for persons with orthopedic physical disability, subject to the condition that an officer not below the rank of Deputy Secretary to the Government of India in the Department of Heavy Industries certifies that the said goods shall be used by the persons with orthopedic physical disability in accordance with the guidelines issued by the said Department

For More Enquiry

Shri M. Subramaniyan

Under Secretary

Ministry of Heavy Industries

Room No. 379 Udyog Bhawan, Rafi Marg, New Delhi

Email id: m.subramaniyan@nic.in

Phone no: 011-23061531

helpdesk.gecs-dhi@gov.in

divya.patel94@gov.in

simmi.narnaulia@nic.in

Can GST benefit available for the deaf and dumb person ?