Tax relief to persons with disability

The parent or guardian of a differently abled person can take an insurance scheme for such person. The present law provides for deduction to the parent or guardian only if the lump sum payment or annuity is available to the differently abled person on the death of the subscriber i.e. parent or guardian.

There could be situations where differently abled dependants may need payment of annuity or lump sum amount even during the lifetime of their parents/guardians. The propose to thus allow the payment of annuity and lump sum amount to the differently abled dependent during the lifetime of parents/guardians, i.e., on parents/ guardians attaining the age of sixty years.

Download Union Budget 2022

Union Budget 2022 – Tax relief details (PDF format)

Notes on Demands for Grants, 2022-2023

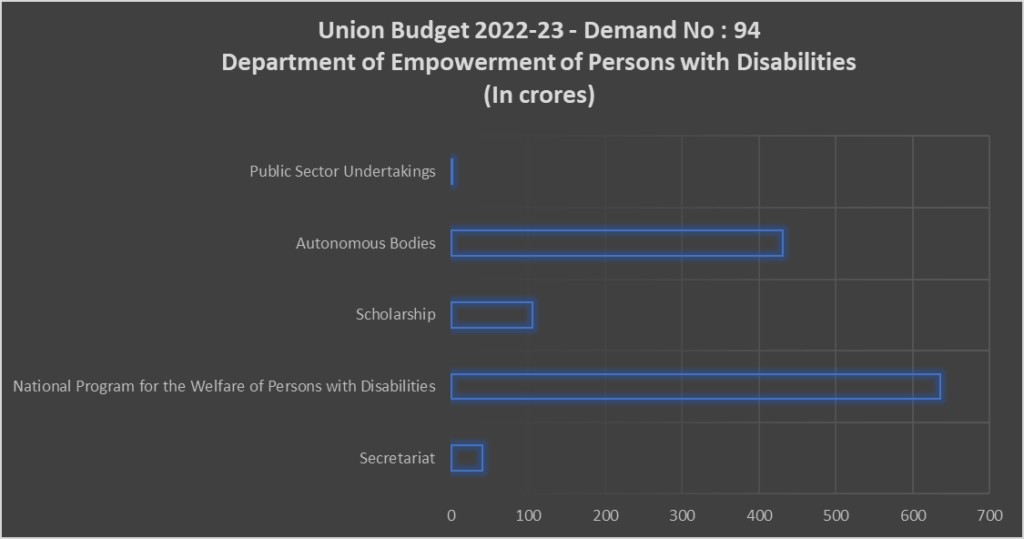

Total 1212.42 Crores

| Budget Demand | Budget 2022-23 (Crores) |

| Secretariat | 40.50 |

| National Program for the Welfare of Persons with Disabilities | 635.39 |

| Scholarship | 105.00 |

| Autonomous Bodies | 431.42 |

| Public Sector Undertakings | 0.11 |

| Total | 1212.42 |

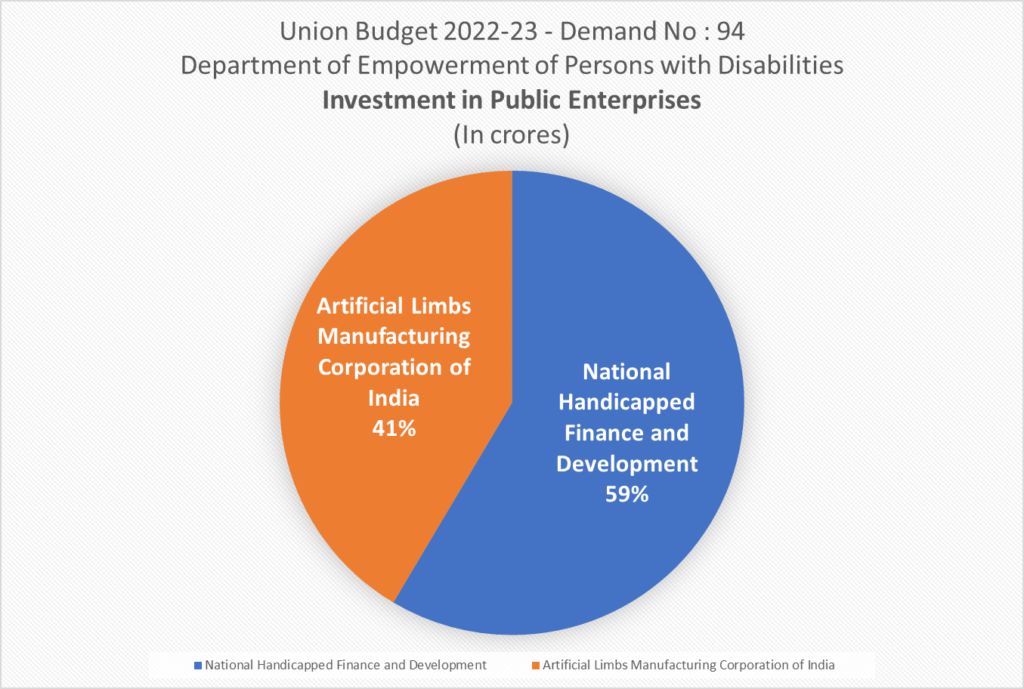

Investment in Public Enterprises

| Investment | Budget 2022-23 |

| National Handicapped Finance and Development | 120.00 |

| Artificial Limbs Manufacturing Corporation of India | 85.00 |

| Total | 205.00 |